What is it?

NetSuite Bank Feeds is a NetSuite SuiteApp that links your online banking profile(s) to your NetSuite environment and allows you to automatically upload and sync your bank and credit card transactional data directly into your NetSuite account. There are currently 10,000 institutions that are available for NetSuite automated banking feeds, with more being added. Currently included list of popular partners include Bank of America, Citi Bank, Chase Bank, Wells Fargo Bank, US Bank, USAA, Capital One Bank, Navy Federal, TD Bank, PNC Bank, KeyBank, Bank of the West, HomeStreet Bank, Union Bank, and thousands more. This list even includes regional and local institutions in the US and Canada.

Learn more about our NetSuite Services

Why you need it?

This will simplify and significantly speed up month-end processes, by letting you reconcile your bank statements as you go throughout the month so that when it comes time to reconcile the bank or credit card statements, you would potentially only have the last few days’ worth to process instead of a month or a period’s worth.

The ease with which you can connect it, with only your online credentials, is the real game changer. No need for a daunting setup, complicated data parsing, and tedious CSV Spreadsheet manipulation and imports!

A significant amount of time will be saved with not having to go to your bank’s online login, download a file, format it, parse it and import it to your account.

How it works?

Just log in to your Financial Institution within the NetSuite Bank Feeds Connector with your simple bank sign-on and match up your accounts to the corresponding accounts within your Chart of Accounts. For accounts with multi-factor authentication, the process might require credentials to be updated more often. However, the automated import can still occur (These are accounts with either one-time password or two-factor authentication.)

There are three types of supported accounts for this process:

- Checking Accounts

- Savings Accounts

- Credit Card Accounts

Only transactions that have been posted or cleared and balances will be brought over. This occurs once a day while you sleep. There is also an option to submit a refresh during the day (there is a 30 minute limit between refreshes).

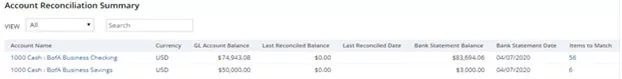

Once records are brought into the system, they are placed on a reconciliation dashboard to be matched and verified.

There are also filters so that certain transactions that you choose will not be brought over or matched if you want to handle them outside of the automated import process.

How do I get it?

To be able to use this SuiteApp, you will need to make sure you are already on release 2020.1, as earlier releases are not compatible. It does, however, work in the 2020.1 Release Preview if you have not yet been upgraded. You will also need to make sure certain features are enabled ahead of time – Custom Records, Client SuiteScript and Server SuiteScript.

From there, you can download the Bank Feeds SuiteApp from the SuiteApp Marketplace within your NetSuite Account.

How do I set it up?

For a simple, easy to follow step by step guide, please visit our next article in the series – “How to Set Up & Configure The NetSuite Bank Feeds SuiteApp“. Our BOLDEnthusiasts will take you through installing the Bank Feeds SuiteApp and configuring it in your NetSuite environment.

Learn more about our NetSuite Services

Conclusion

There you go! We have prepackaged all the basics of the NetSuite Bank Feeds SuiteApp for you in this blog! I hope it brings more clarity to your NetSuite endeavors. For help with this SuiteApp or any other configuration changes, implementation, or just plain being stuck, please reach out to our BOLDCommunity and our BOLDEnthusiasts.

If you have any question or queries, do not hesitate to reach out to us!

Get in touch: [email protected]

Finally!